Landed cost Voucher

For creating a Landed cost voucher in OneOfficeERP: You have to create it against a Purchase Receipt and Purchase Invoice.

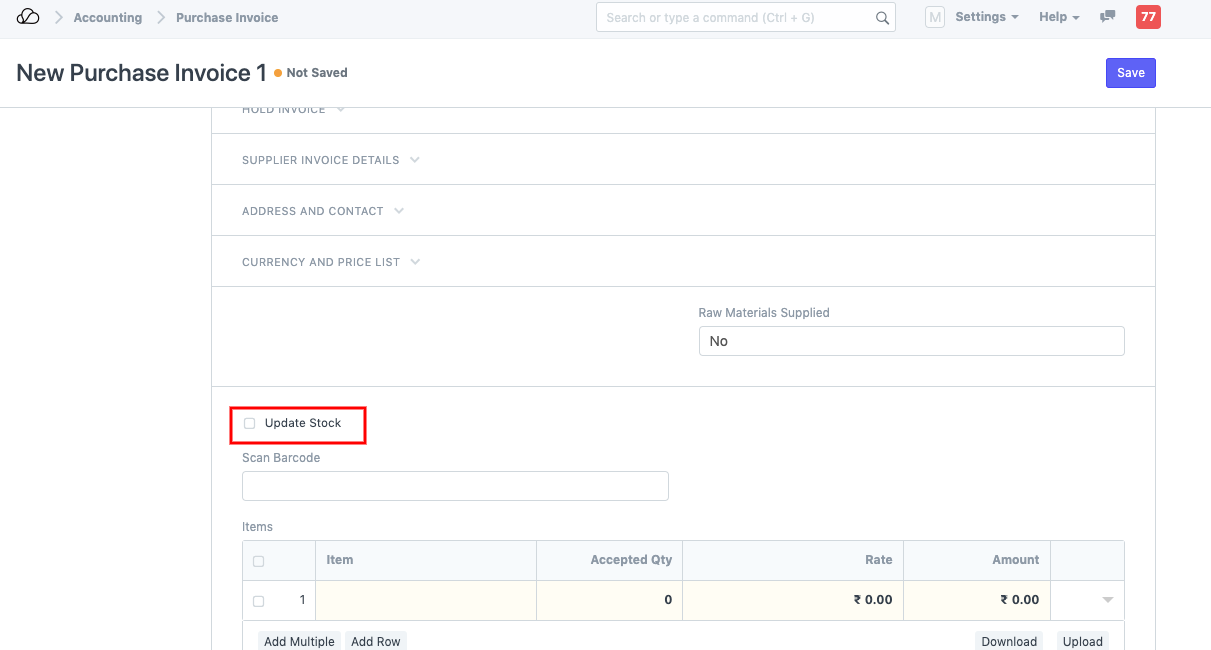

While creating against Purchase Invoice: In the Purchase Invoice --> Update Stock should be checked.

If this field is unchecked, the Purchase Invoices will not be fetched in the Landed Cost Voucher

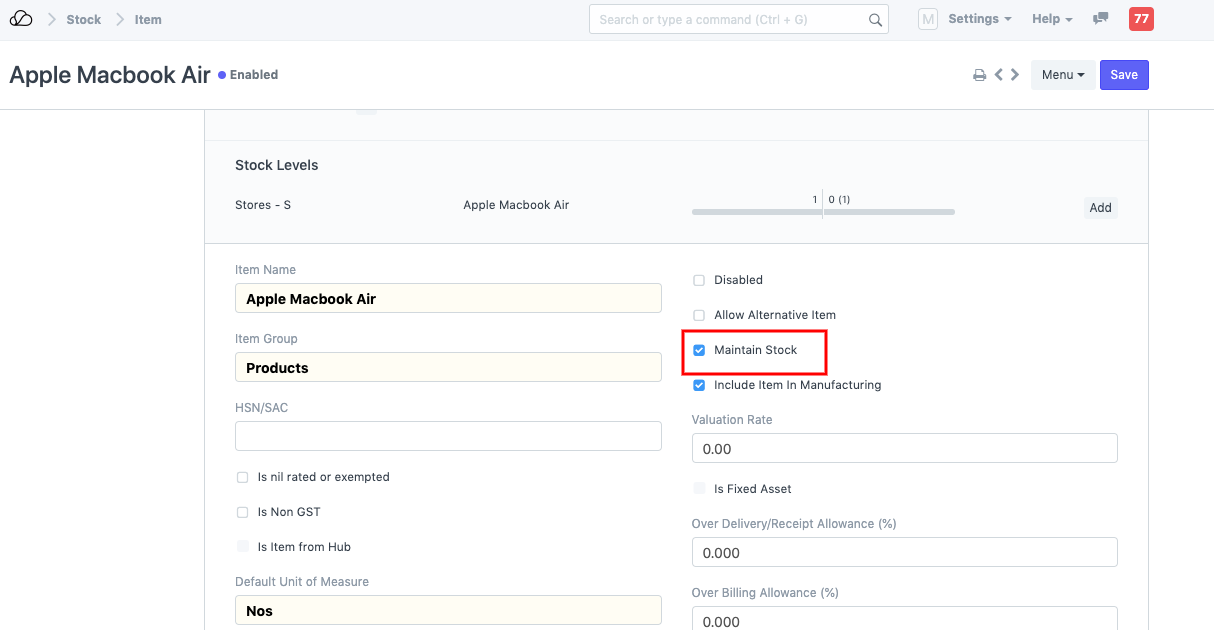

While creating against Purchase Receipt: The Item selected should have Maintain Stock checked.

If this field is not checked, the Items will not be displayed when you click Get items from Purchase Receipt.

While creating a Landed cost Voucher, additional costs can be added for the items until they land in our Inventory.

These additional charges once added, get added in the Item Valuation rate and update the Item Rate.

You can trace this additional charge effect on the Accounting ledger in the Purchase Receipt --> View --> Accounting Ledger

If the additional charges have to be paid against the Landed Cost Voucher, you can:

-

You can create a Payment Entry directly to complete the payment for additional expenses for the Item and then create a Purchase Invoice with Is Paid checked --> [In this case, Purchase Invoice is not mandatory unless you want the accounting effect to be seen. ]

-

You can create a Purchase Invoice for a Supplier for which the Additional Expenses are incurred, this way you can see the Accounting effect for the expenses as per the Landed Cost Voucher, then create a Payment entry against it.