Employee Tax Exemption Declaration

Tax exemption is the monetary exemption of income, property or transactions from taxes that would otherwise be levied on an Employee.

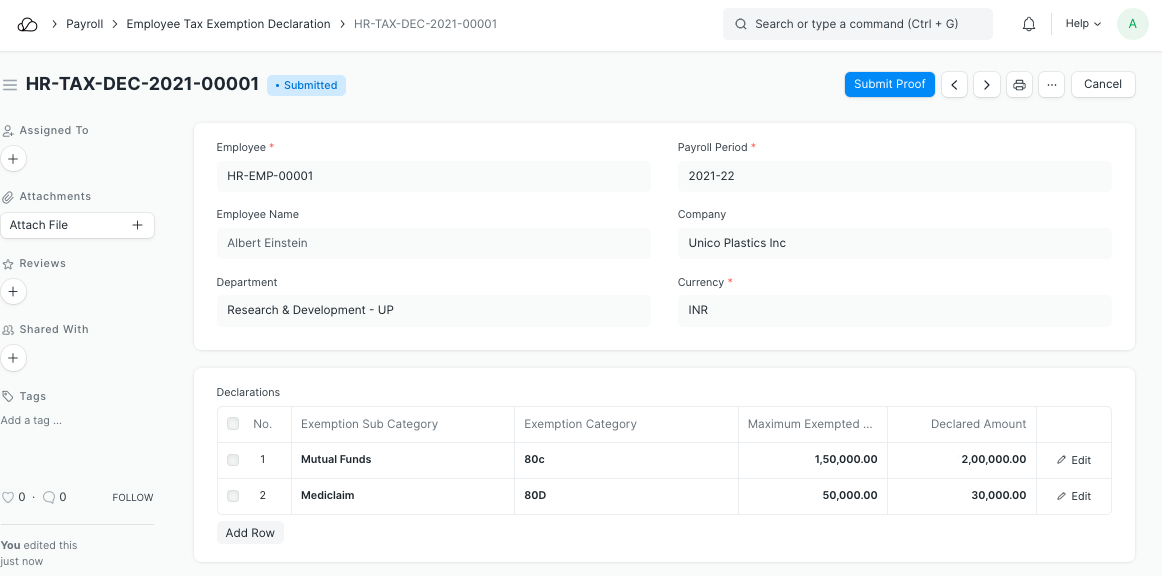

At the beginning of a Payroll Period, employees can declare the amount of exemption they will be claiming from their taxable salary. OneOfficeERP allows you to specify tax exemption category/sub-category, tax exemption amount and other related information in the Employee Tax Exemption Declaration form.

To access Employee Tax Exemption Declaration, go to:

Home > Human resources > Employee Tax and Benefits > Employee Tax Exemption Declaration

1. Prerequisites

Before creating an Employee Tax Exemption Declaration, it is advisable you create the following:

2. How to create Employee Tax Exemption Declaration

To create a new Employee Tax Exemption Declaration:

- Go to: Employee Tax Exemption Declaration > New.

- Select the Exemption Sub Category and Exemption Category.

- Enter the Maximum Exemption Amount and Declared Amount.

- Save and Submit.

The Total Exemption Amount will be exempted from annual taxable earnings of the employee while calculating the tax deductions in Payroll.

Note: Employees can only submit one Employee Tax Exemption Declaration for a Payroll Period.

3. Features

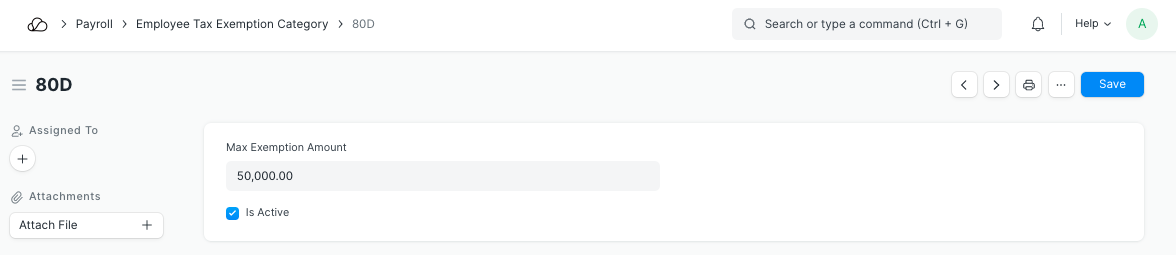

3.1 Employee Tax Exemption Category

Exemptions from taxable salary are usually restricted to spendings on particular categories decided by the Government or regulatory agencies. OneOfficeERP allows you to configure various categories which are allowed to be exempted.

You can configure Employee Tax Exemption Category by going to, Employee Tax and Benefits > Employee Tax Exemption Category

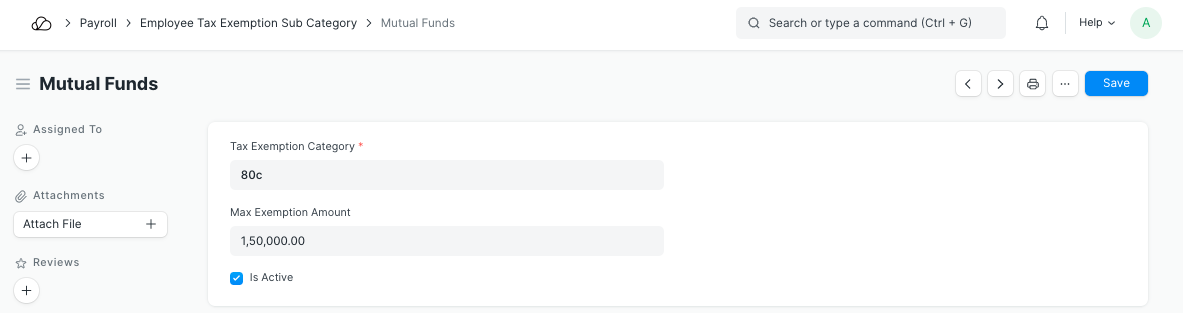

3.2 Employee Tax Exemption Sub-Category

Under each category, there could be many heads for which the exemptions are allowed.

You can configure Employee Tax Exemption Category by going to, Employee Tax and Benefits > Employee Tax Exemption Sub-Category