Employee Tax Exemption Proof Submission

Employees are required to submit proofs for all the spendings they claim tax exemption for. This can be done through the Employee Tax Exemption Proof Submission document

1. Introduction

This is usually done at the end of a Payroll Period, but employees can submit any number of proofs unlike Employee Tax Exemption Declaration.

Note: Create an Employee Tax Exemption Declaration before creating an Employee Tax Exemption Proof Submission

To access Employee Tax Exemption Proof Submission, go to:

Home > Human resources > Employee Tax Exemption Proof Submission

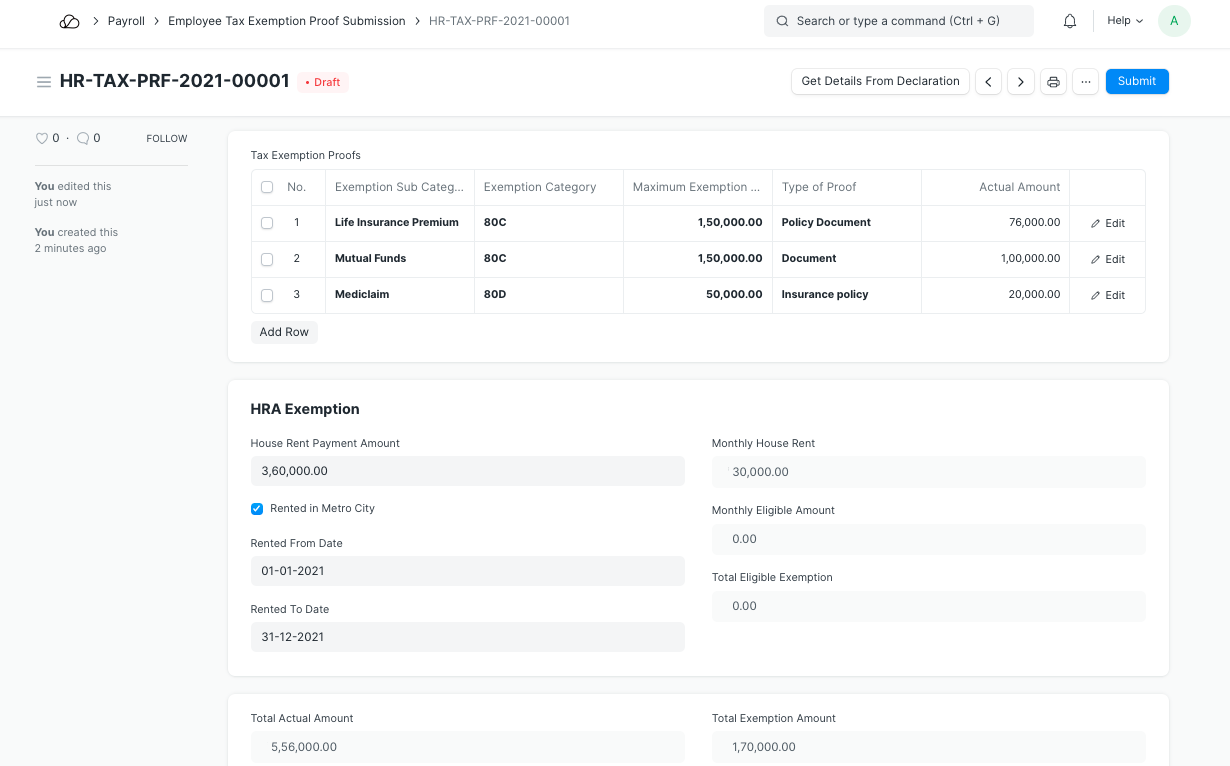

2. How to create an Employee Tax Exemption Proof Submission

The details are already fetched if you click on 'Submit Proof' from Employee Tax Exemption Declaration. However, if you want to create an 'Employee Tax Exemption Proof Submission' manually, follow these steps.

- Go to the Employee Tax Exemption Proof Submission list, click on New.

- Enter the details as needed.

- Additionally, enter the 'Type of Proof' (documents, receipts, etc.).

- Attach the proofs in by clicking on the Attach button at the bottom.

- Enter House Rent Payment Amount, Rented From Date and Rented To Date.

- Save and Submit.

The Total Exemption Amount will be exempted from annual taxable earnings of the employee while calculating the tax deductions in the last payroll.

Note: Even if employees submit exemption proofs anytime during the payroll period, OneOfficeERP will only consider this in the last payroll of the Payroll Period for adjusting the final taxes based on the proof submitted. If you need to adjust any additional tax collected or consider proof submission of employees anytime before the last payroll, while processing Payroll Entry (or in the Salary Slip of the employee) check the Deduct Tax For Unsubmitted Tax Exemption Proof option.