Setting Up

Users & Permissions

Print

Email

System Configuration

Data Privacy

Articles

Using OOERP

Collaboration

Articles

Accounts

Setup

Journals & Payments

Tools

Advanced

Opening Balance

Shareholders

Articles

Asset

Buying

Basics

Setting Up

Articles

CRM

Reports

Setting Up

Human Resources

Setting Up

Employees

Attendance

Leaves

Employee Lifecycle

Payroll

Tax & Benefits

Performance

Travel & Expense Claim

Gratuity

Reports

Articles

E-Commerce

Loan Management

Loan Cycle

Articles

Projects

Project Management

Time Tracking

Advanced

Quality Management

Selling

Setting Up

Reports

Articles

Stock

Variants

Transactions

Serials & Batches

Returns

Reports

Articles

Support

Website

Agriculture

Diseases & Fertilizer

Analytics

Education

LMS

Setting Up

Schedule

Healthcare

Setting Up

Consultation

Nursing

Rehabilitation

Hospitality

Manufacturing

Bill Of Materials

Reports

Articles

Non Profit

Membership

Volunteers

Donors

Grants

Chapters

Customization

Records

Navigation

Articles

Integration

Banks

E-Commerce

Shipping

Payment

Taxes

Telephony

Regional

Germany

United Arab Emirates

South Africa

Saudi Arabia

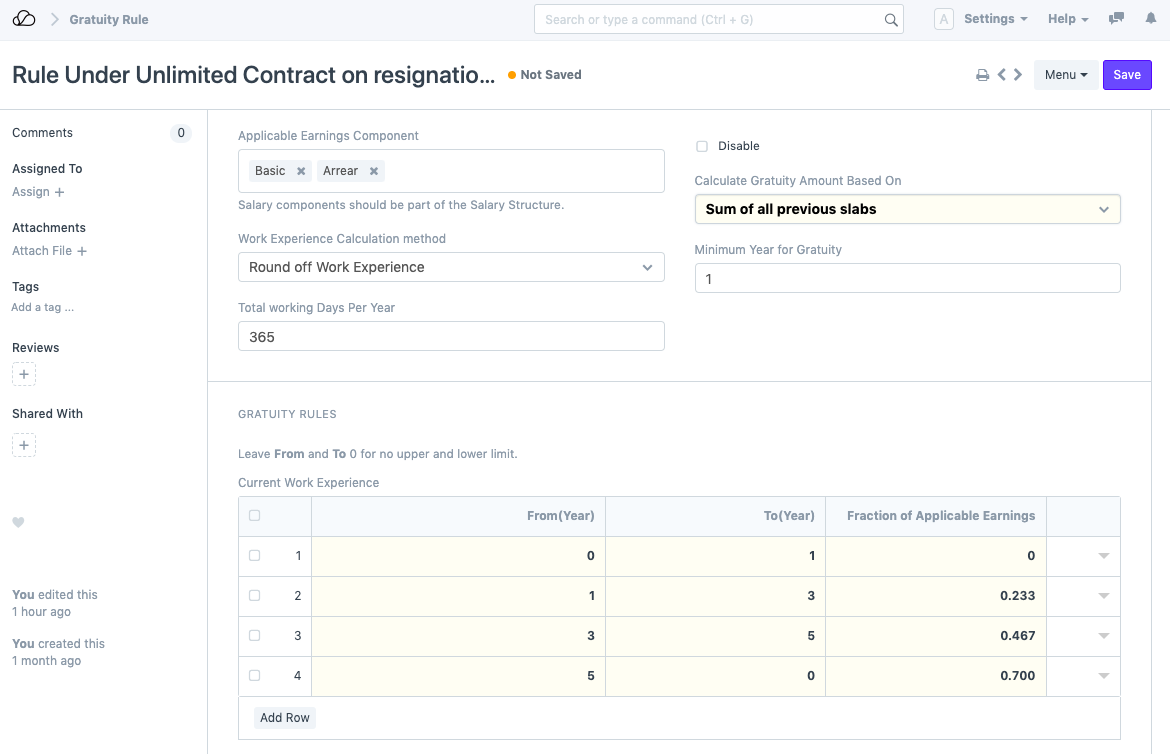

Gratuity Rule

Gratuity Rule are set of rule defined by Central or State used during calculation of Gratuity Amount

In OneOfficeERP, you can define different Gratuity Rules based on different Region.

To access the Gratuity Rule, go to:

Home > Payroll > Gratuity Rule

1. Prerequisites

Before creating an Gratuity Rule, it is advised to create the following:

2. How to create Gratuity Rule

- Got to Gratuity Rule > New

- Select Applicable Components. These Salary Components contribute during Gratuity Calculation.

- Select "Calculate Gratuity Amount based on"

- Define Gratuity Rule

- Save

3. Additional Properties

Some of the additional attributes used while gratuity Calculation are define below.

3.1 Work Experience Calculation method:

OneOfficeERP provide two different method for calculation of Work experience.

- Round off Work Experience method Round off yor current experience. For example, if employee have total experience of 3 year and 6 month will be treated as 4 year experience.

- Take Exact Completed Year.

3.2 Calculate Gratuity Amount Based On:

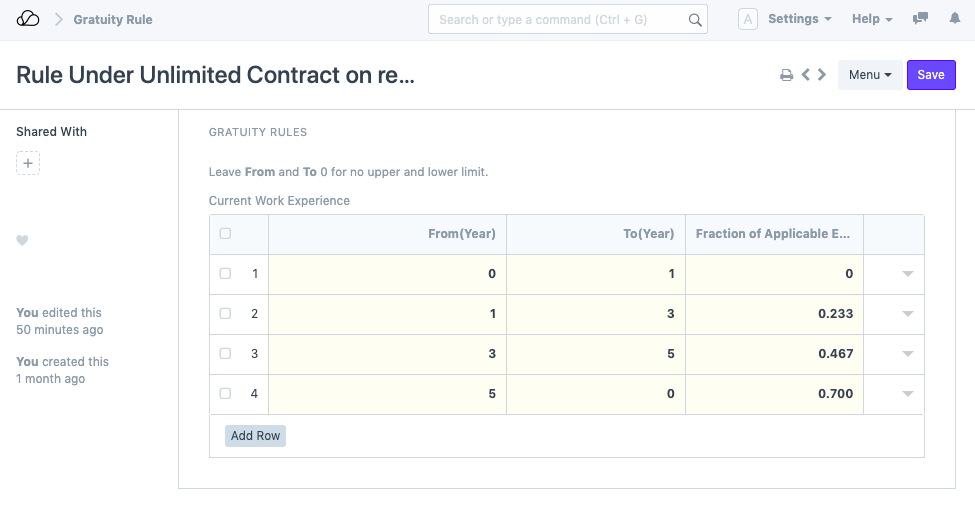

Let's consider the following example to understand the calculation.

- Current slab: If Gratuity Amount calculation is based on Current Slab, then amount will be the product of Work Experience (in years), Fraction of Applicable Earnings and summation of the Applicable Earnings Components. Based on above Gratuity Rules/slab, if an employee has an experience of 5 years, then it falls in third slab. The calculation of Gratuity Amount will be as follows:

Gratuity amount = 5 * 0.467 * (Arrear + Basic)

- Sum of all previous slabs: If Gratuity Amount calculation is based on Sum of all previous slabs, then amount will be the summation of product of individual slabs up to the year of experience and summation of Applicable Earnings Component. Based on above Gratuity Rules/slab, if an employee has an experience of 5 years, then the calculation of Gratuity Amount will be as follows:

Gratuity amount = [(1 * 0) + (2 * 0.233) + (2 * 0.467)]*(Arrear + Basic)