Setting Up

Users & Permissions

Print

Email

System Configuration

Data Privacy

Articles

Using OOERP

Collaboration

Articles

Accounts

Setup

Journals & Payments

Tools

Advanced

Opening Balance

Shareholders

Articles

Asset

Buying

Basics

Setting Up

Articles

CRM

Reports

Setting Up

Human Resources

Setting Up

Employees

Attendance

Leaves

Employee Lifecycle

Payroll

Tax & Benefits

Performance

Travel & Expense Claim

Gratuity

Reports

Articles

E-Commerce

Loan Management

Loan Cycle

Articles

Projects

Project Management

Time Tracking

Advanced

Quality Management

Selling

Setting Up

Reports

Articles

Stock

Variants

Transactions

Serials & Batches

Returns

Reports

Articles

Support

Website

Agriculture

Diseases & Fertilizer

Analytics

Education

LMS

Setting Up

Schedule

Healthcare

Setting Up

Consultation

Nursing

Rehabilitation

Hospitality

Manufacturing

Bill Of Materials

Reports

Articles

Non Profit

Membership

Volunteers

Donors

Grants

Chapters

Customization

Records

Navigation

Articles

Integration

Banks

E-Commerce

Shipping

Payment

Taxes

Telephony

Regional

Germany

United Arab Emirates

South Africa

Saudi Arabia

Tax on another tax amount

Use Case: Need to calculate tax on the previous tax amount and not on the item amount.

For example, we have 5 items and Service Charge is calculated on the Net Total of the 5 items. Additionally, we need to calculate 5% VAT on the Service Charge of the Items and not on the Net Total of the Invoice. In this case, you need to follow the following steps:

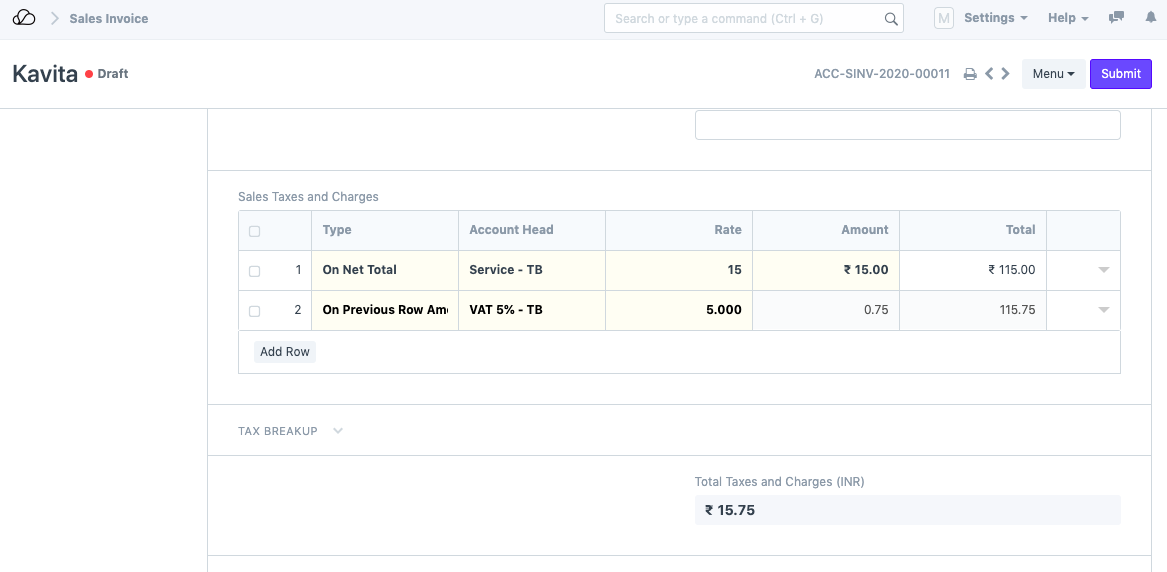

- In Sales Invoice, under the Sales Taxes and Charges section you need to set the tax calculation. In row 1, select the Type as "On Net Total" and Account Head as needed. Enter the Rate if not set already.

The amount for this particular account head is calculated under the Amount column.

-

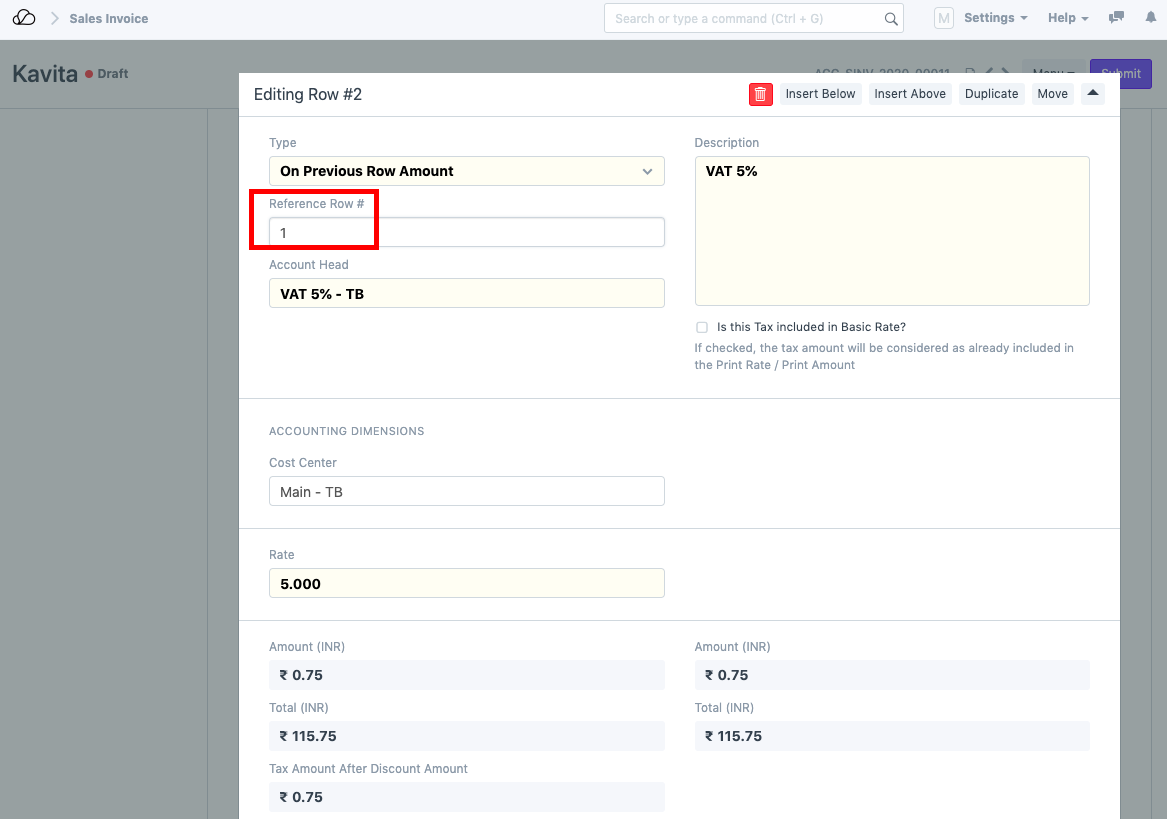

Next, you need to calculate tax on the previous row's amount (which is the tax amount). To do this, select the Type as "On Previous Row Amount". Set the Account Head and Rate as needed. Expand the row and set the Reference Row # as shown below.

The Sales Taxes and Charges section set looks as follows: