Employee Benefit Claim

Employee Benefit Claim allows Employees to - 1. Claim flexible benefits which are to be received lump-sum (if Salary Component is Pay Against Benefit Claim) 2. Claim tax exemption for flexible benefits received pro-rata, as part of salary when Deduct Tax For Unclaimed Employee Benefits is checked in Payroll Entry / Salary Slip

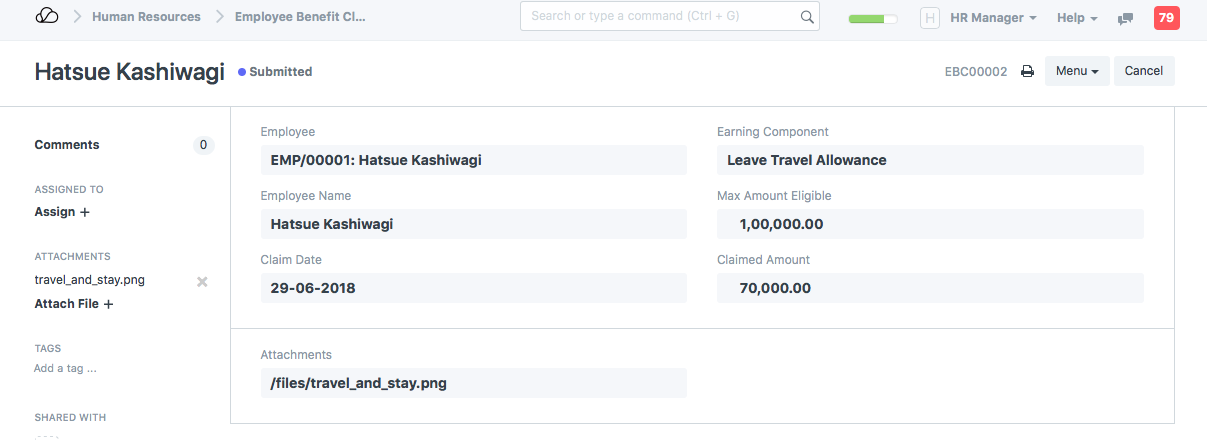

You can create a new Employee Benefit Claim by going to,

Human Resources > Payroll > Employee Benefit Claim > New Employee Benefit Claim

Here, Employee can view the eligible amount as per their Salary Structure Assignment and claim for the amount which they wish to receive as part of their next Salary. Any remaining amount which the employee did not claim for, in a Payroll Period, will be disbursed as part of the last payroll Salary.

Note: Normal Tax calculation does not include Flexible Benefits as in most cases these are exempted from Tax. To tax these components anytime before the last payroll, use Deduct Tax For Unclaimed Employee Benefits in Payroll Entry / Salary Slip while processing the Salary.