Setting Up

Users & Permissions

Print

Email

System Configuration

Data Privacy

Articles

Using OOERP

Collaboration

Articles

Accounts

Setup

Journals & Payments

Tools

Advanced

Opening Balance

Shareholders

Articles

Asset

Buying

Basics

Setting Up

Articles

CRM

Reports

Setting Up

Human Resources

Setting Up

Employees

Attendance

Leaves

Employee Lifecycle

Payroll

Tax & Benefits

Performance

Travel & Expense Claim

Gratuity

Reports

Articles

E-Commerce

Loan Management

Loan Cycle

Articles

Projects

Project Management

Time Tracking

Advanced

Quality Management

Selling

Setting Up

Reports

Articles

Stock

Variants

Transactions

Serials & Batches

Returns

Reports

Articles

Support

Website

Agriculture

Diseases & Fertilizer

Analytics

Education

LMS

Setting Up

Schedule

Healthcare

Setting Up

Consultation

Nursing

Rehabilitation

Hospitality

Manufacturing

Bill Of Materials

Reports

Articles

Non Profit

Membership

Volunteers

Donors

Grants

Chapters

Customization

Records

Navigation

Articles

Integration

Banks

E-Commerce

Shipping

Payment

Taxes

Telephony

Regional

Germany

United Arab Emirates

South Africa

Saudi Arabia

Calculating Freight in taxes in OneOfficeERP

Use case: To calculate freight forwarding charges with tax rate

When freight is supposed to be calculated in forwarding charges as a tax rate, we can follow the steps as below:

-

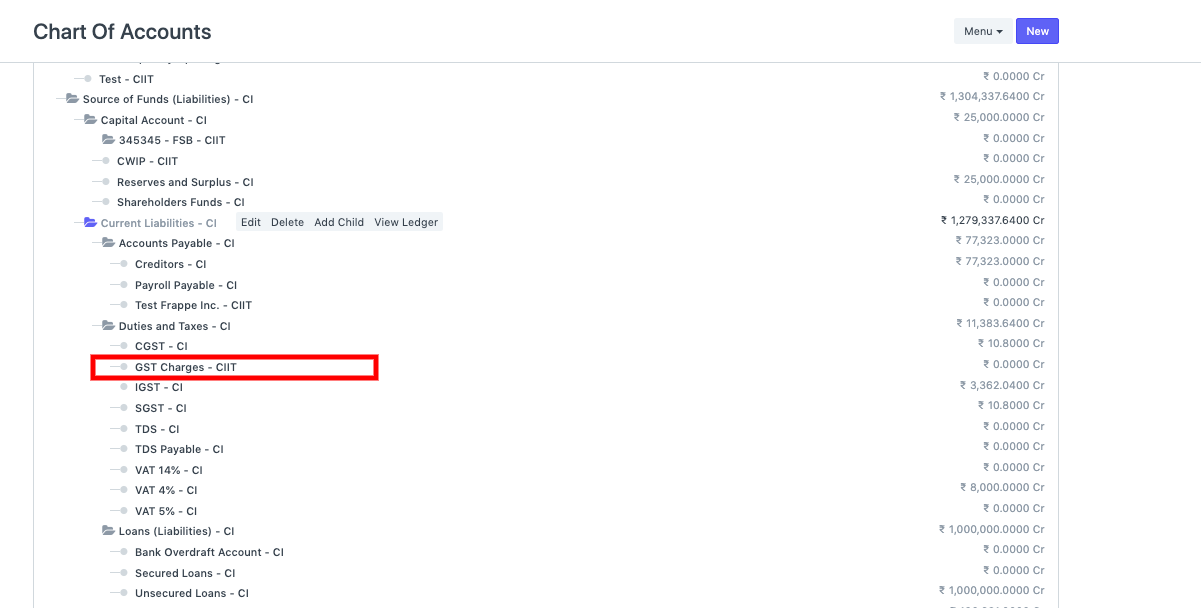

You can create a ledger in the taxes account specifically in Chart of Accounts, else you can consider GST tax account in the taxations for calculation of the Freight charges.

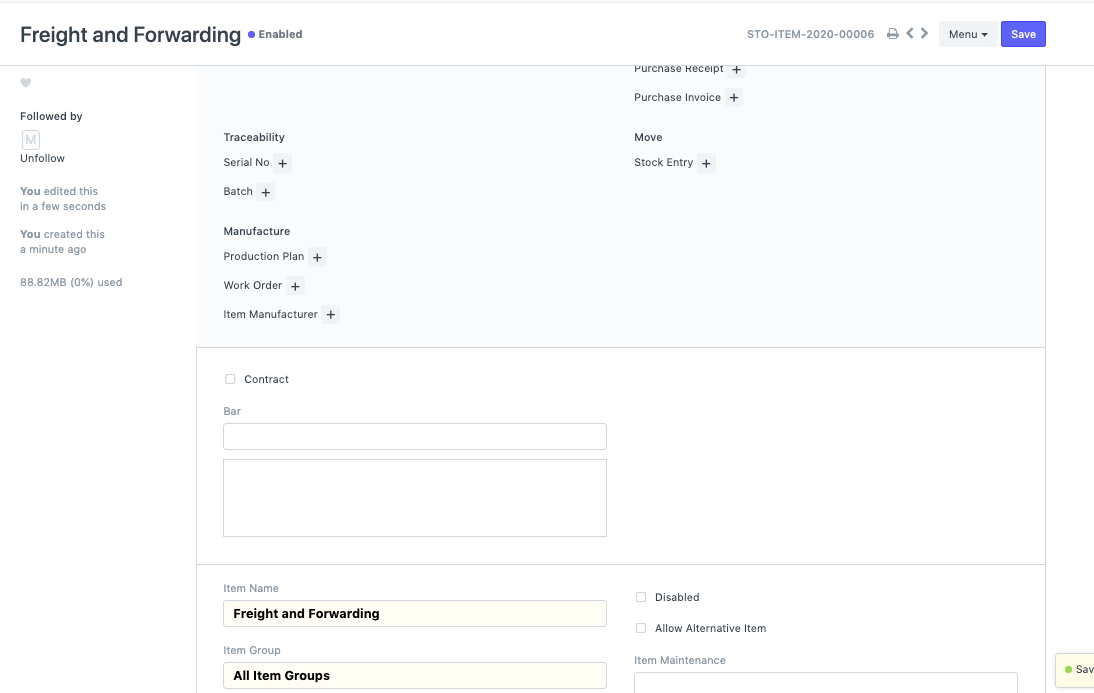

- Now create an Item with the name : Freight and Forwarding

-

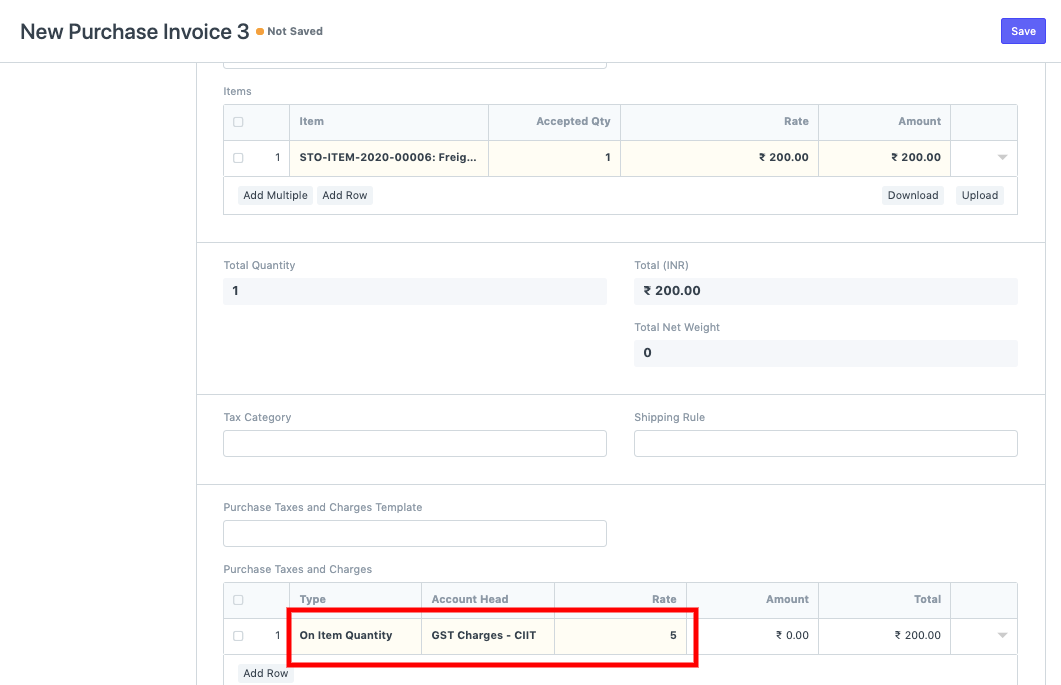

You can now create Purchase Invoice for the Supplier and add this item to calculate the Taxes related to the freight. You can set the freight tax based on the Net total or Item Quantity as per the company policy.