Stock Transfer with GST

In certain situations, there are statutory requirements where taxes are to be applied on each transfer of Material. It is easier to manage it in a transaction like a Sales Invoice, than in the Stock Entry. Please follow the following steps to transfer material from one branch to another using Sales and Purchase Invoice

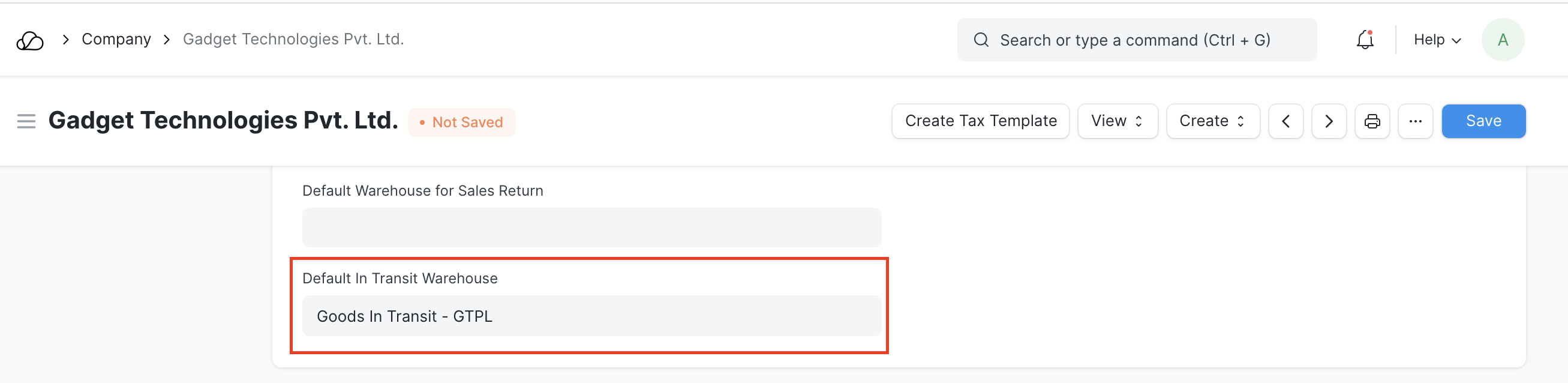

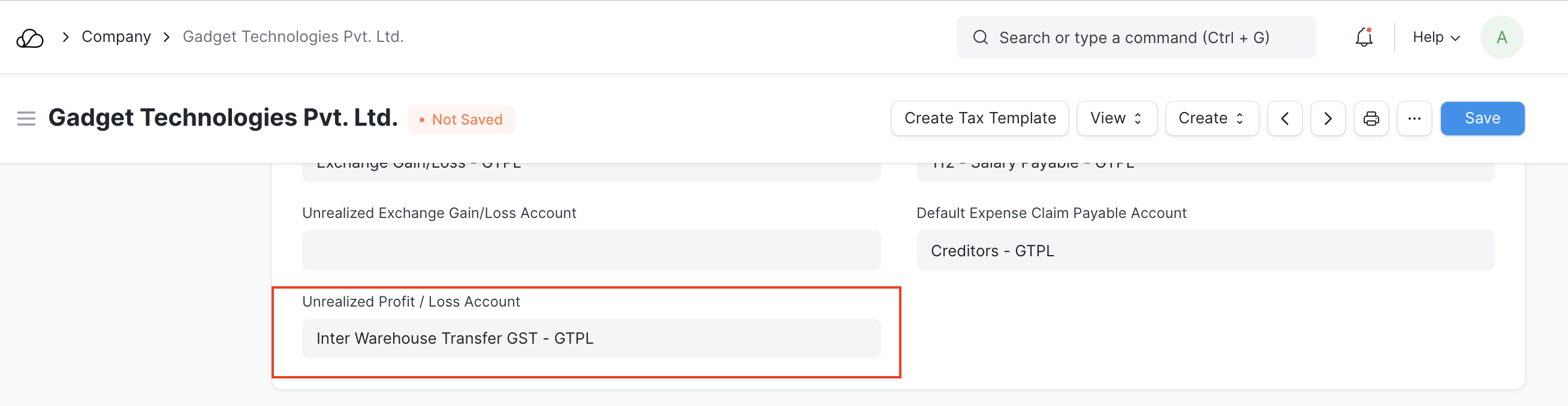

Step 1 - Add default Unrealized Profit and loss account and default In-Transit warehouse in the company master

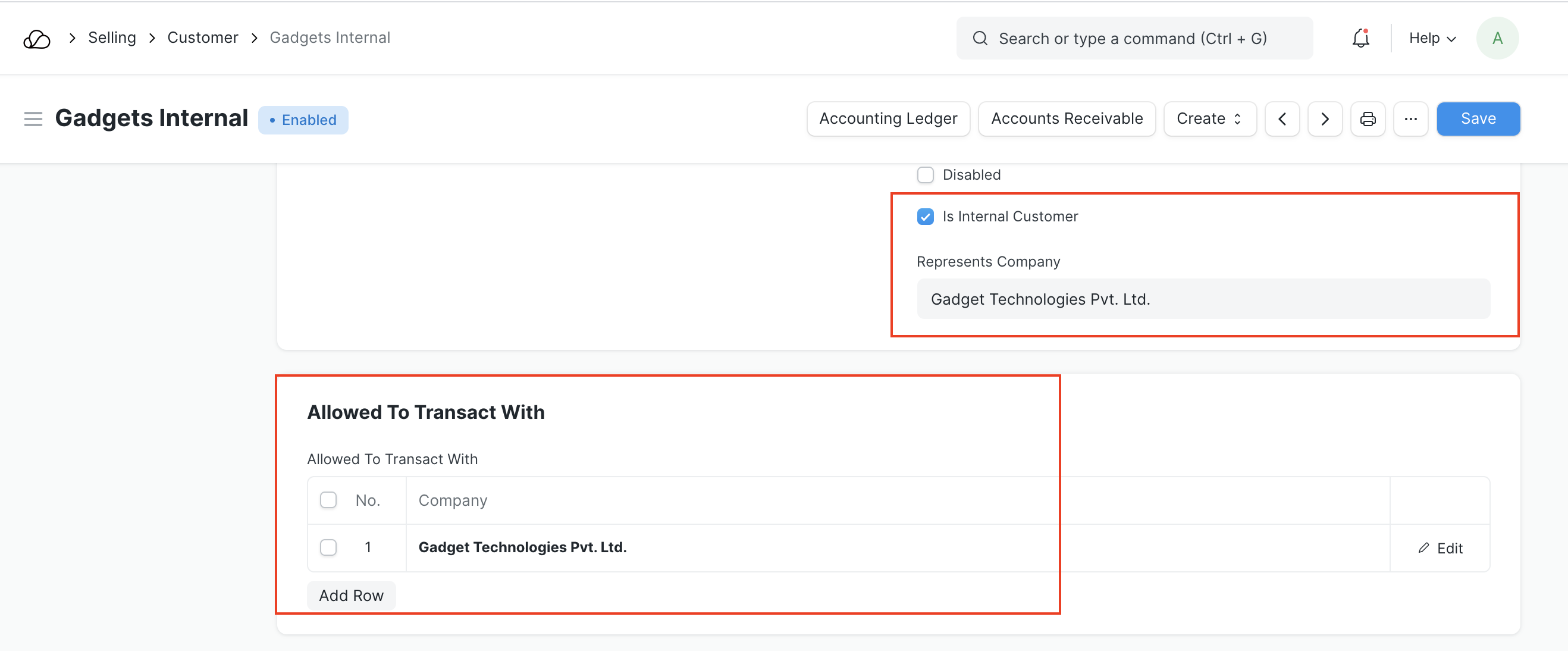

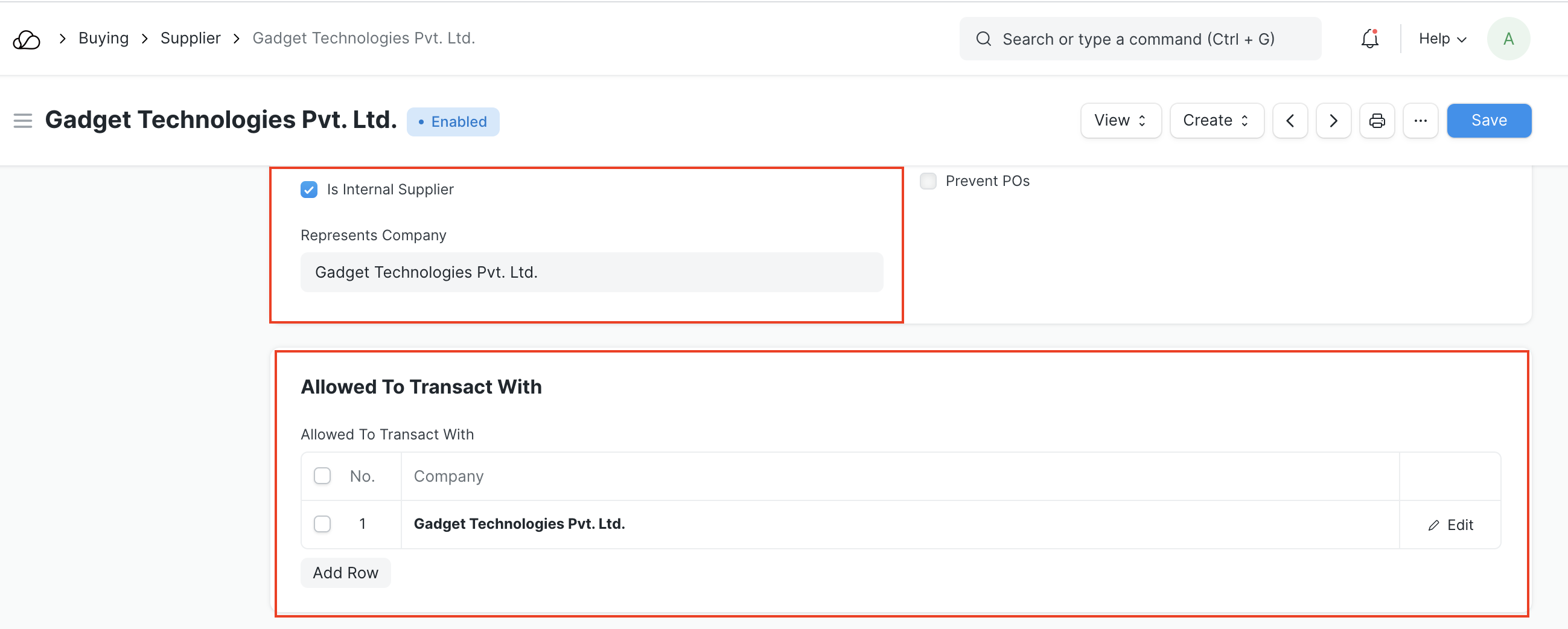

Step 2 - Create Internal Customer and Supplier and allow them to transact with the same company. Also, link appropriate address and GST details with the respective parties

Step 3 - Create Sales Invoice (Delivering the items from source)

3.1 Select the internal customer you created in your previous step

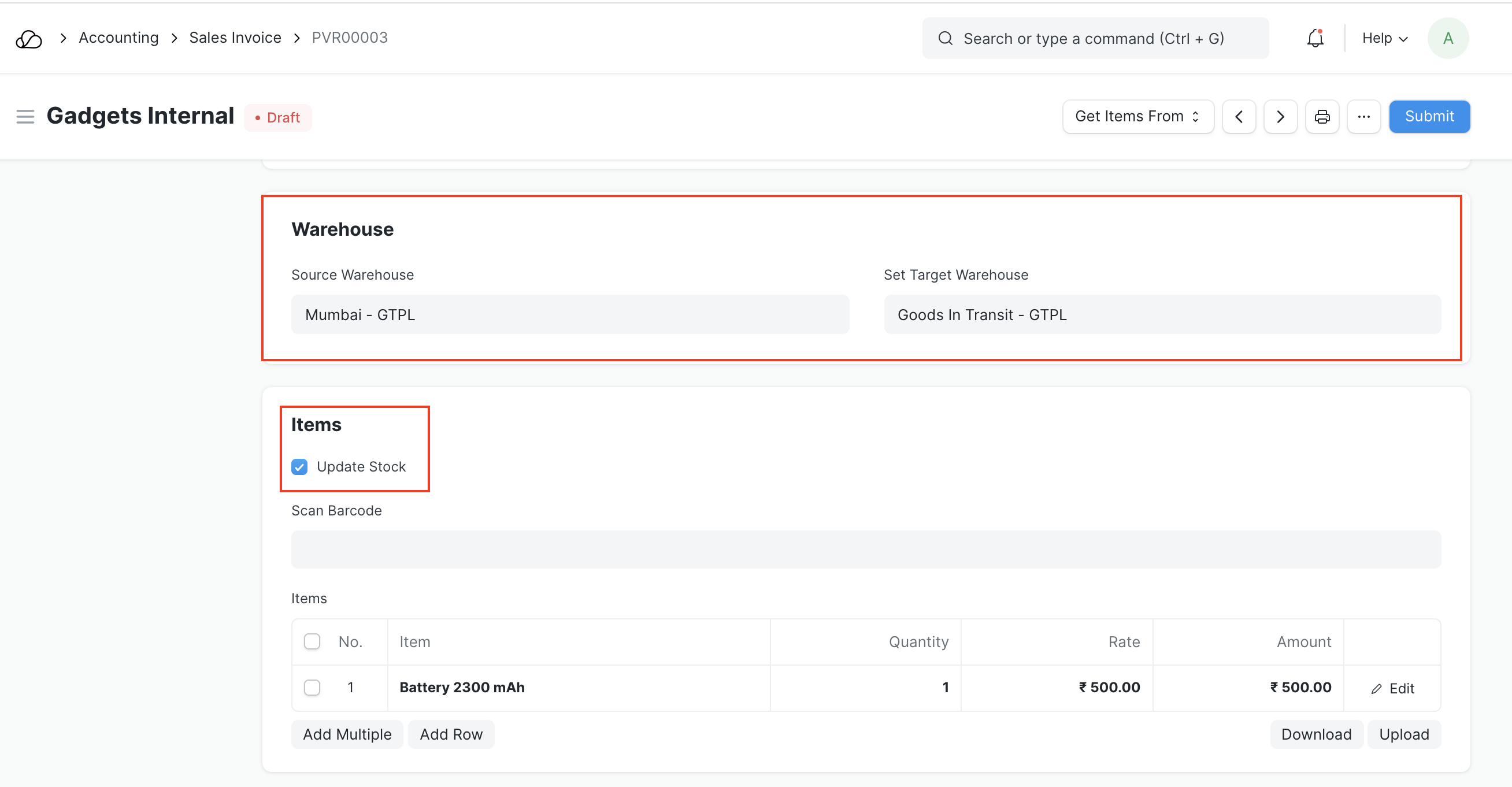

3.2 Check update stock

3.3 Add items to be transferred along with the Source Warehouse and Target Warehouse as the In-Transit warehouse

3.4 Save and Submit

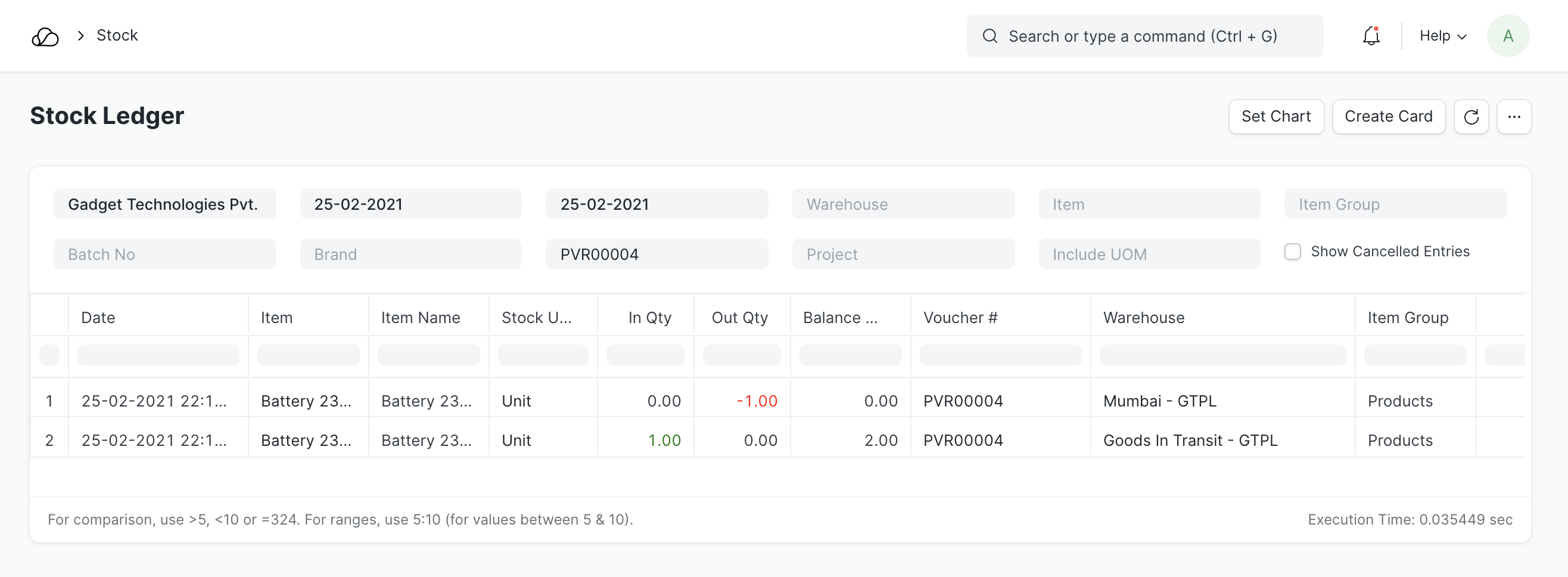

Stock Ledger

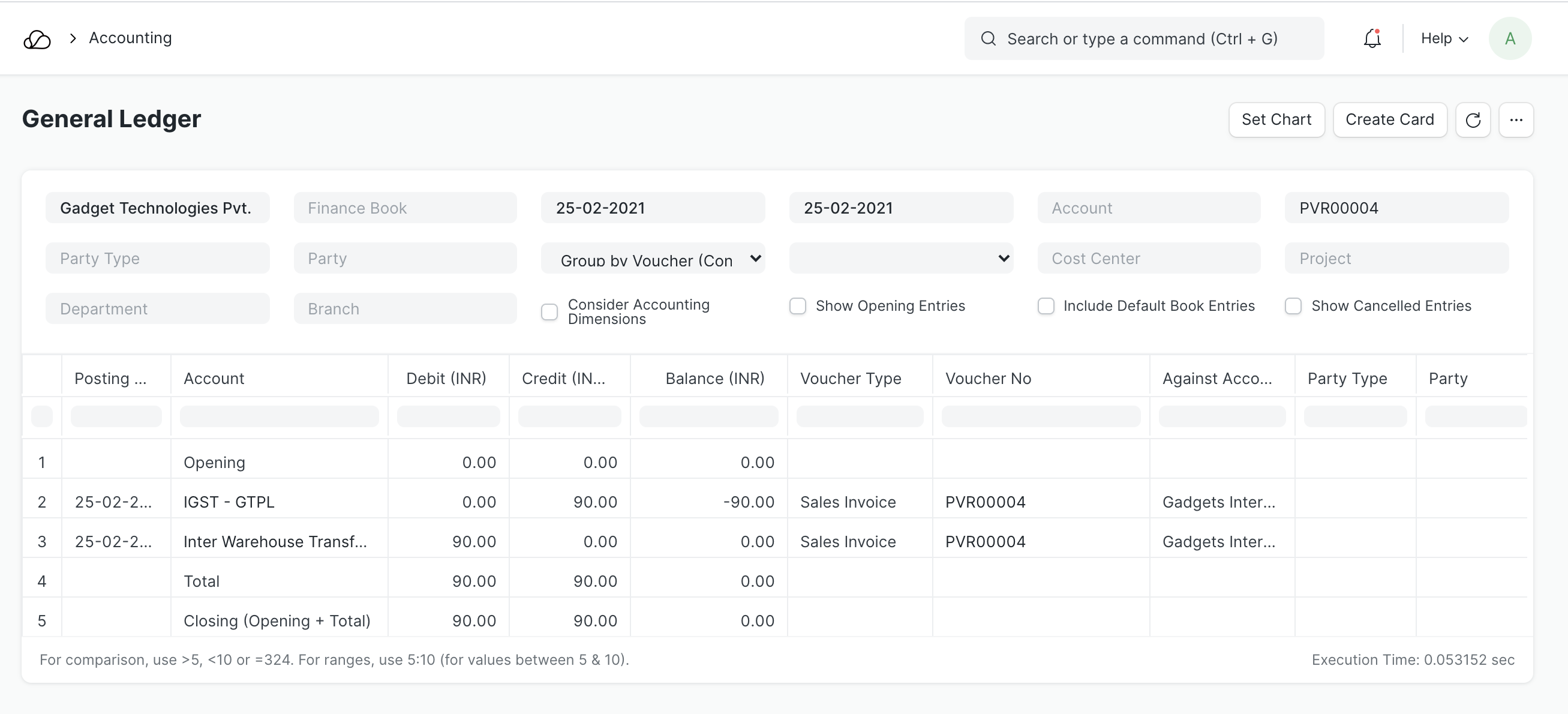

Accounting Ledger

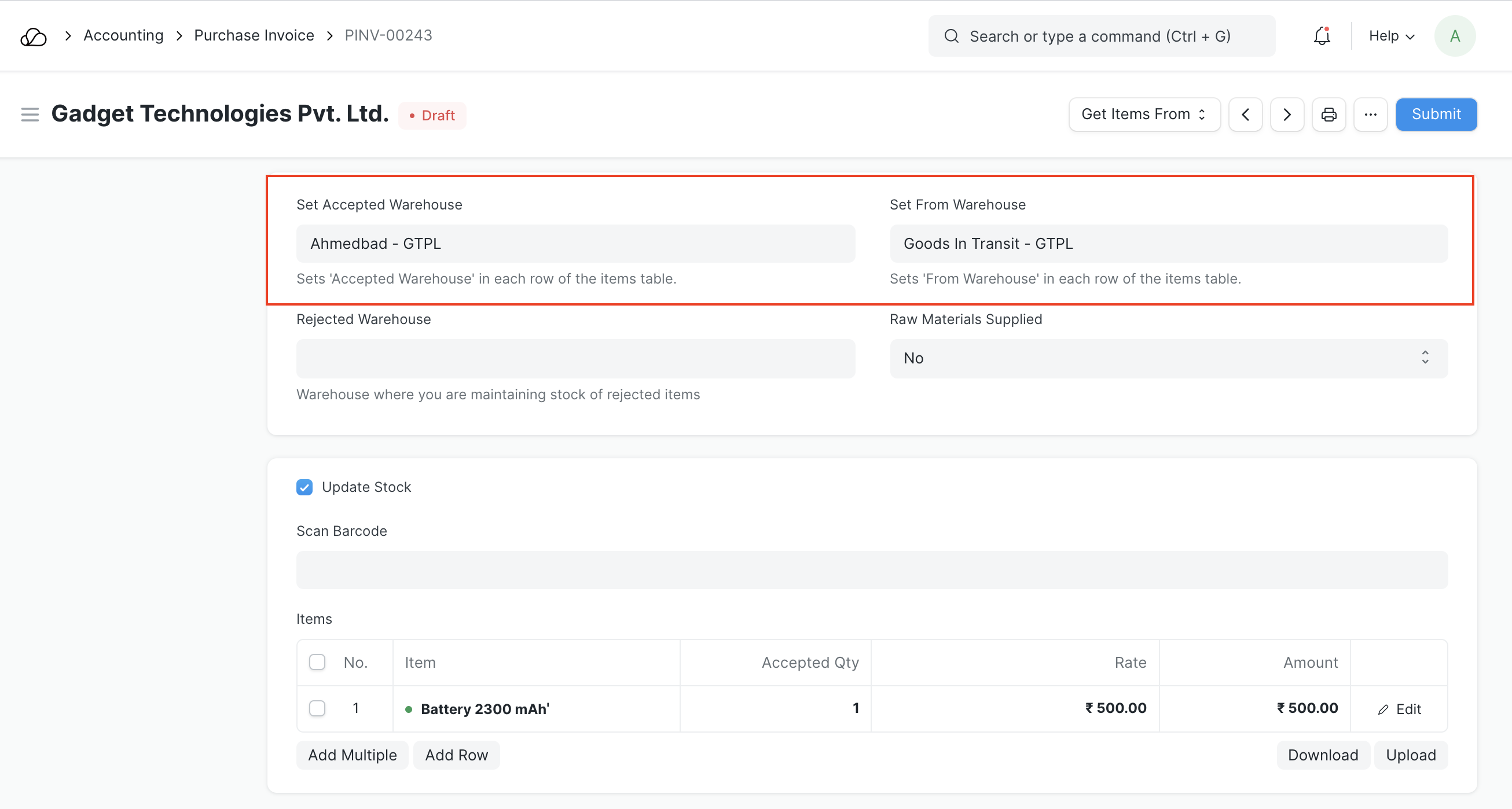

Step 4 - Create Purchase Invoice (Receiving Items at destination)

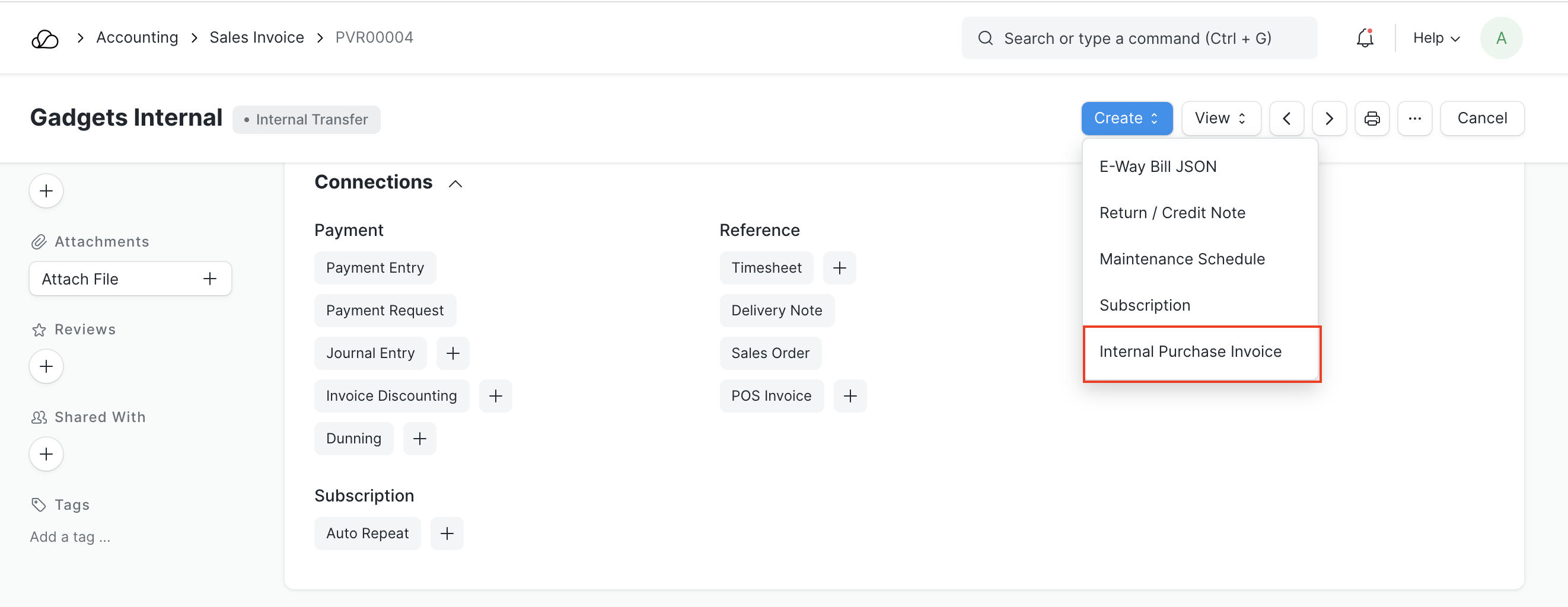

Use the "Create Internal Purchase Invoice" button from the sales invoice to create Purchase Invoice

Select the Accepted Warehouse (warehouse at which stock has been received) and save and submit

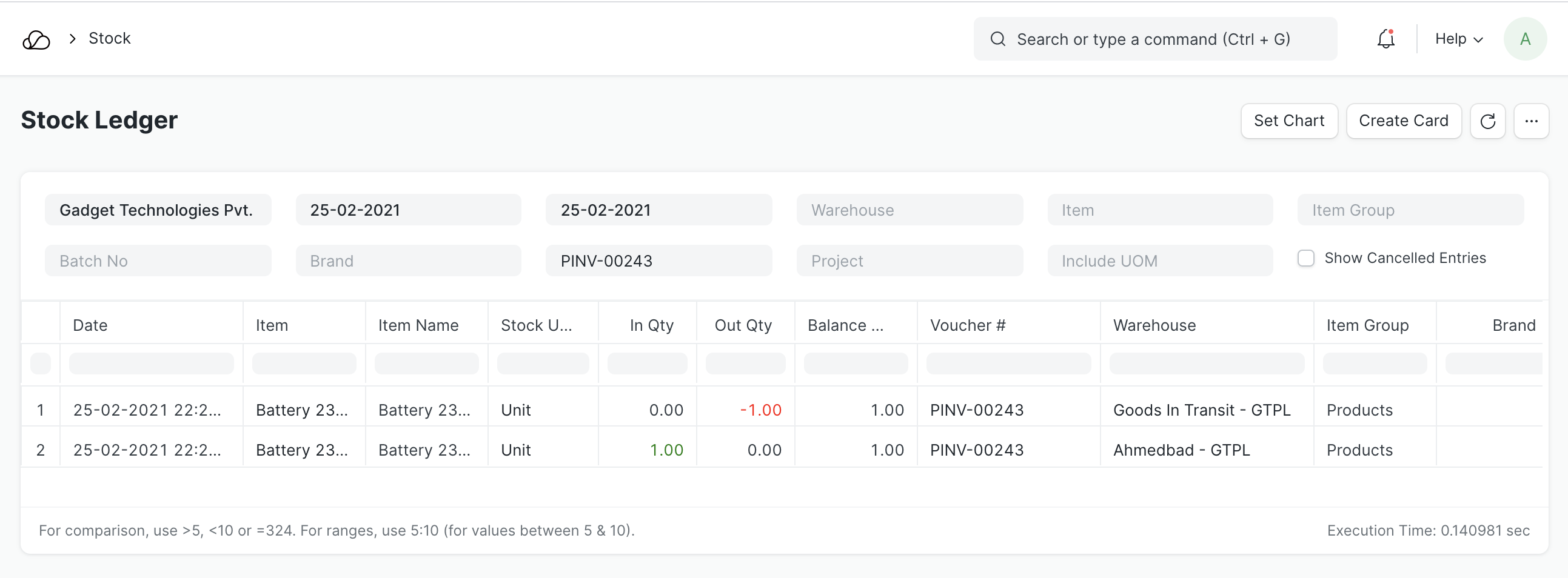

Stock Ledger

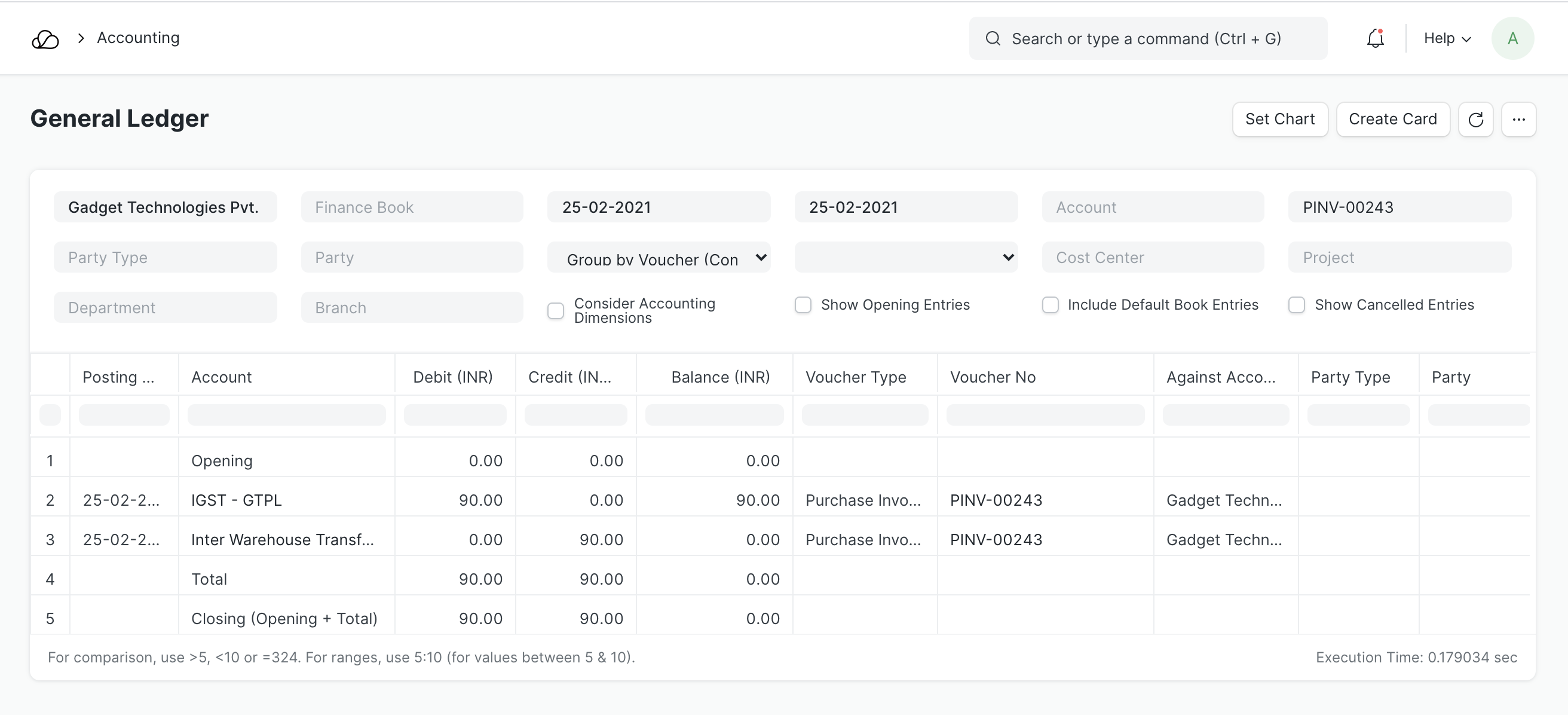

Accounting Ledger

Note: Application of GST automatically on invoices is subjective to your GST configuration. Make sure you have proper tax templates configurated and appropriate addresses and GST details linked to the internal parties