Debit Note

A Debit Note is a document sent by a buyer to the Supplier notifying that a debit has been recorded against the goods returned to the Supplier.

A Debit Note is issued for the value of the goods returned. In some cases, sellers are seen sending Debit Notes which should be treated as like another invoice.

A Debit is for your record of the debit against the Items your return.

1. How to create Debit Note

The user can make a Debit Note against the Purchase Invoice or they can directly make Debit Note from the Purchase Invoice without reference.

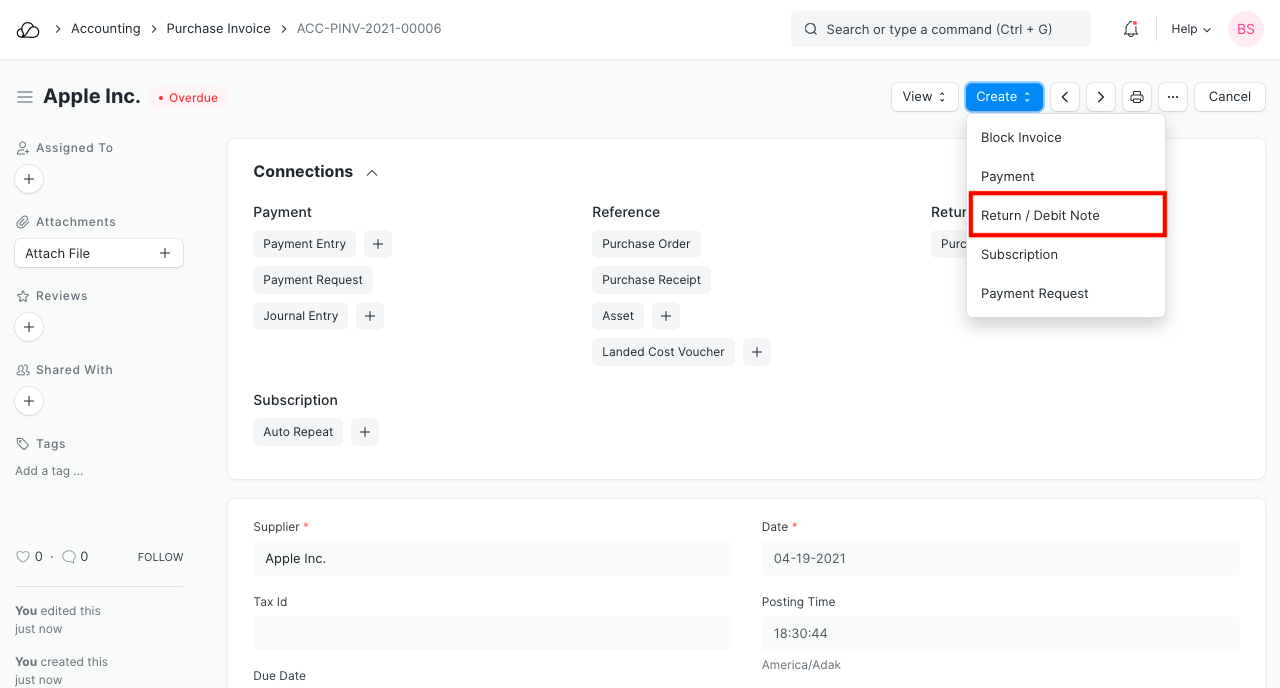

- Go to the respective Purchase Invoice and click on Create > Return / Debit Note.

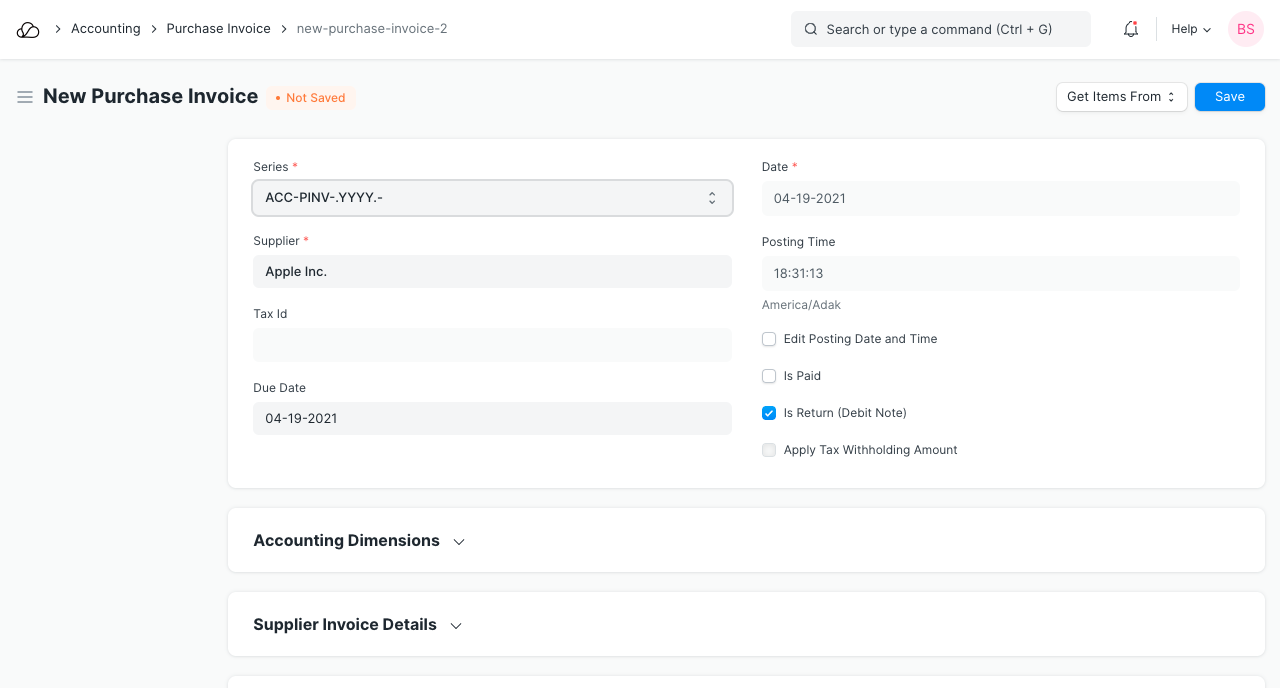

2. The Supplier and Item details will be fetched as set in the Purchase Invoice.

3. If you had paid partially or fully, make a Payment Entry against the original Purchase Invoice.

4. Save and Submit.

2. The Supplier and Item details will be fetched as set in the Purchase Invoice.

3. If you had paid partially or fully, make a Payment Entry against the original Purchase Invoice.

4. Save and Submit.

The other steps are similar to a Purchase Invoice.

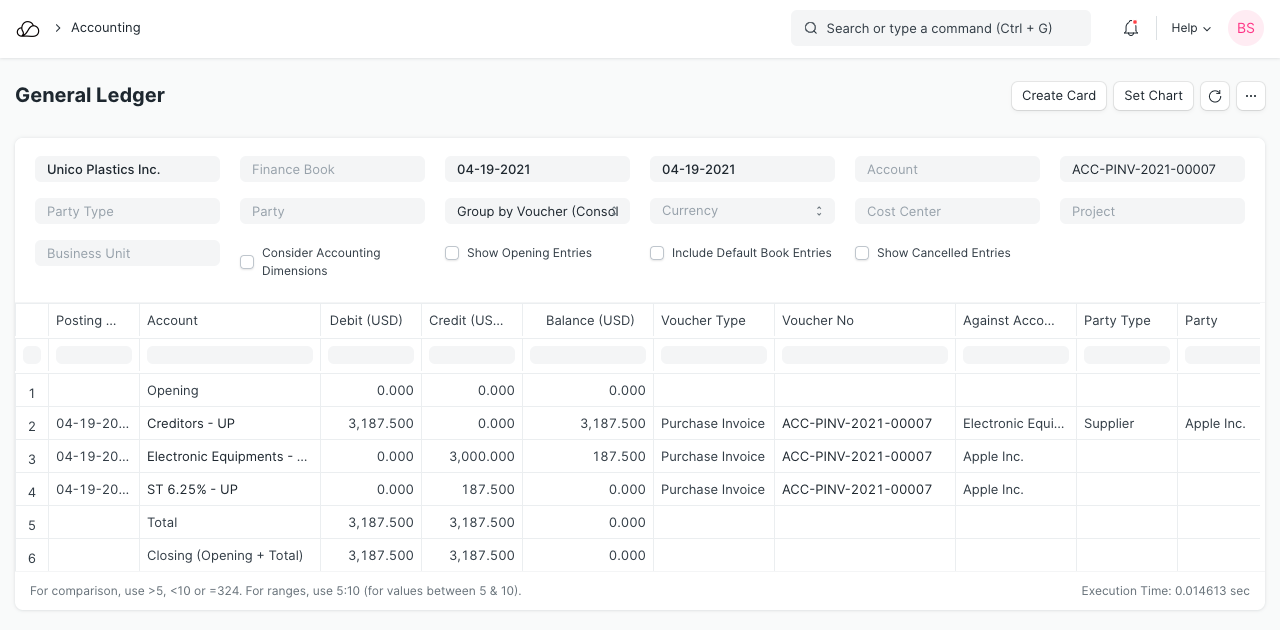

1.1 How does Debit Note affect ledger

The Debit Note will reverse the impact of the purchase invoice.

Refer the Purchase Invoice page for any other details.

1.2 No payment was made against Sales Invoice

In case no payment was made against the original invoice, you could just cancel the Sales Invoice. But, if only 5 out of 10 Items are being returned from an invoice, creating a Debit Note is useful for updating the ledger.

2. Example

From Supplier Blue Mills, you had purchased Cotton worth $2400 + taxes and at the time of delivery, you found that the products were damaged. Now you returned the product a Debit Note will be issued.

Debit Note with payment entry in OneOfficeERP for above example is as below: