Accounting Entries

Accounting Entries The concept of accounting is explained with an example given below: We will take a "Tea Stall" as a company and see how to book accounting entries for the business.

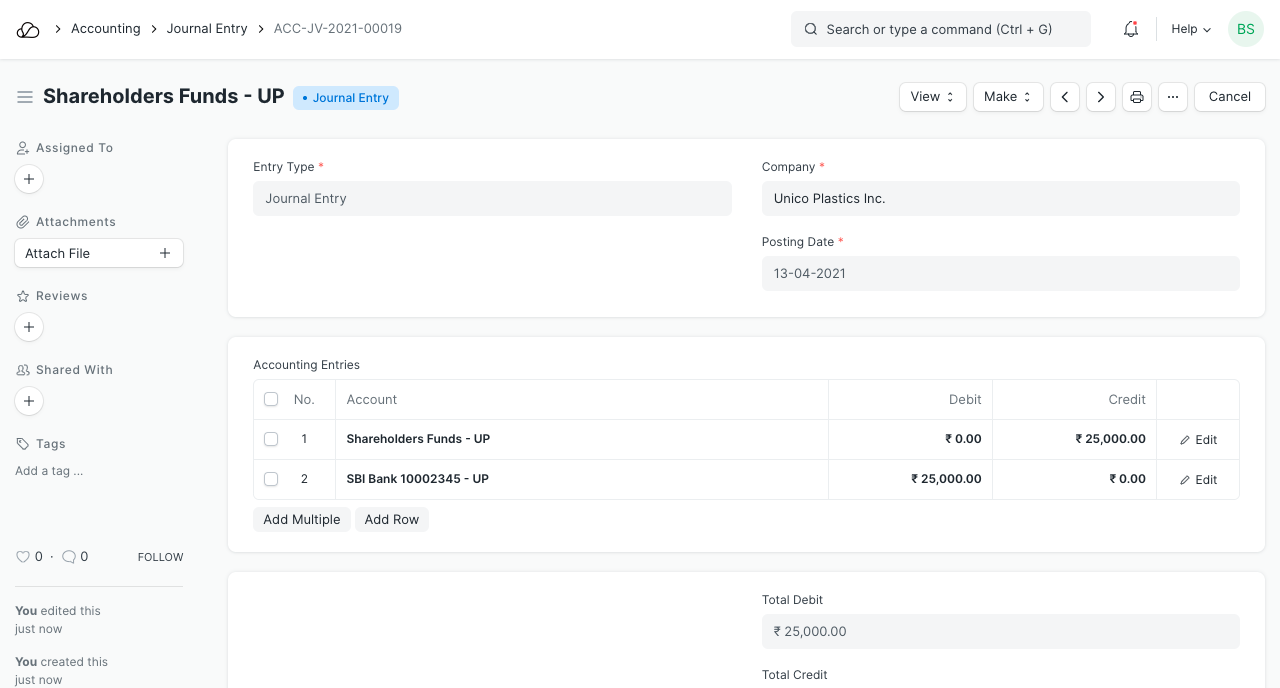

Mama (The Tea-stall owner) invests $25000 to start the business.

1. Investment

Mama invested $25000 in Company, hoping to get some profit. In other words, company is liable to pay $25000 to Mama in the future. So, account "Mama" is a liability account and it is credited. Company's cash balance will be increased due to the investment. "Cash" is an asset to the company and it will be debited.

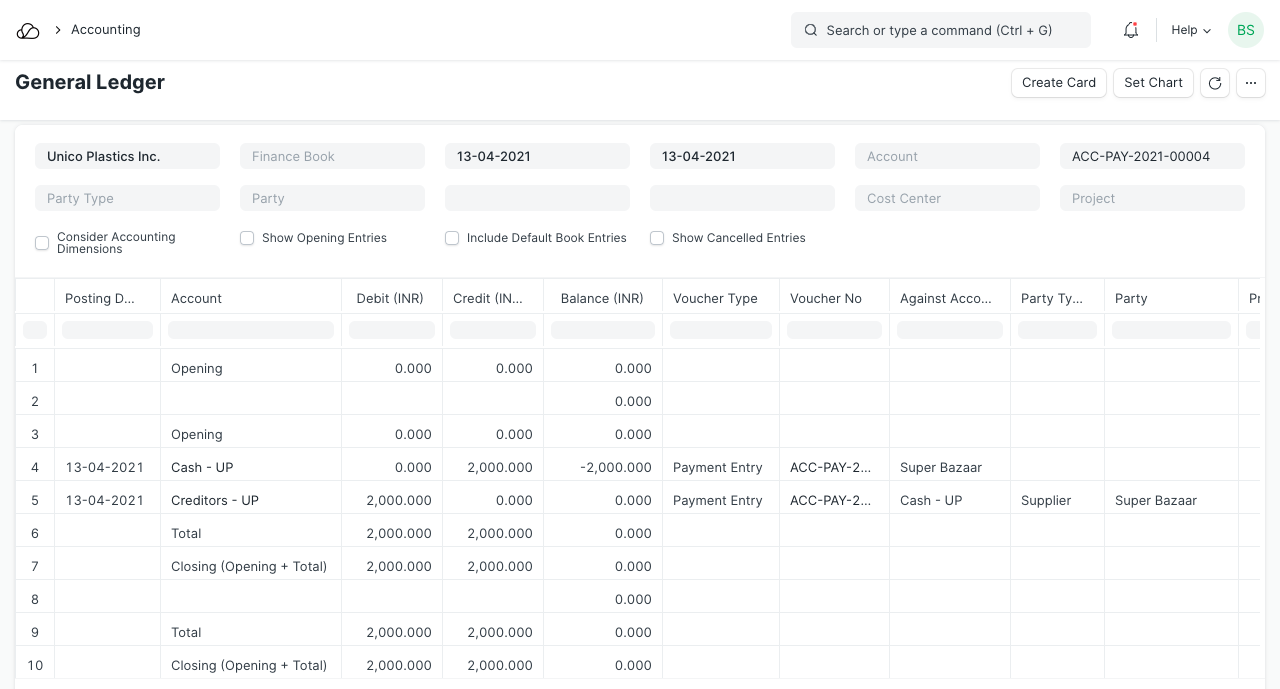

The company needs equipments (stove, teapot, cups, etc.) and raw materials (tea, sugar, milk, etc.) immediately. He decides to buy them from the nearest general store, "Super Bazaar" whose owner is a friend, so that he gets some credit. Equipments cost him $2800 and raw materials $2200. He pays $2000 out of the total cost which is $5000. This can be recorded in OneOfficeERP using a Payment Entry.

2. Assets

Equipments are "Fixed Assets" (because they have a long life) and raw materials are "Current Assets" (since they are used for day-to-day business), of the company. So, "Equipments" and "Stock in Hand" accounts have been debited to increase the value. He pays 2000, so "Cash" account will be reduced by that amount, hence credited and he is liable to pay $3000 to "Super Bazaar" later, so Super Bazaar will be credited by $3000.

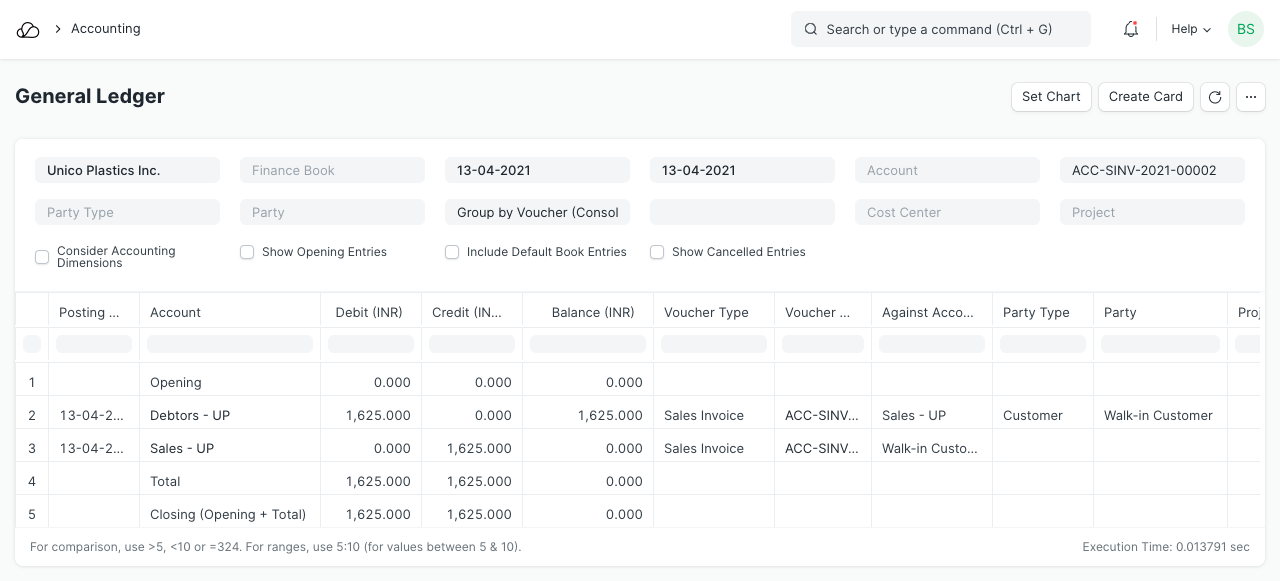

Mama (who takes care of all entries) decides to book sales at the end of every day, so that he can analyze daily sales. At the end of the very first day, the tea stall sells 325 cups of tea, which gives net sales of $1625. The owner happily books his first day sales.

3. Income

Income has been booked in "Sales of Tea" account which has been credited to increase the value and the same amount will be debited to "Cash" account. Lets say, to make 325 cups of tea, it costs $800, so "Stock in Hand" will be reduced (Cr) by $800 and expense will be booked in "Cost of goods sold" account by same amount.

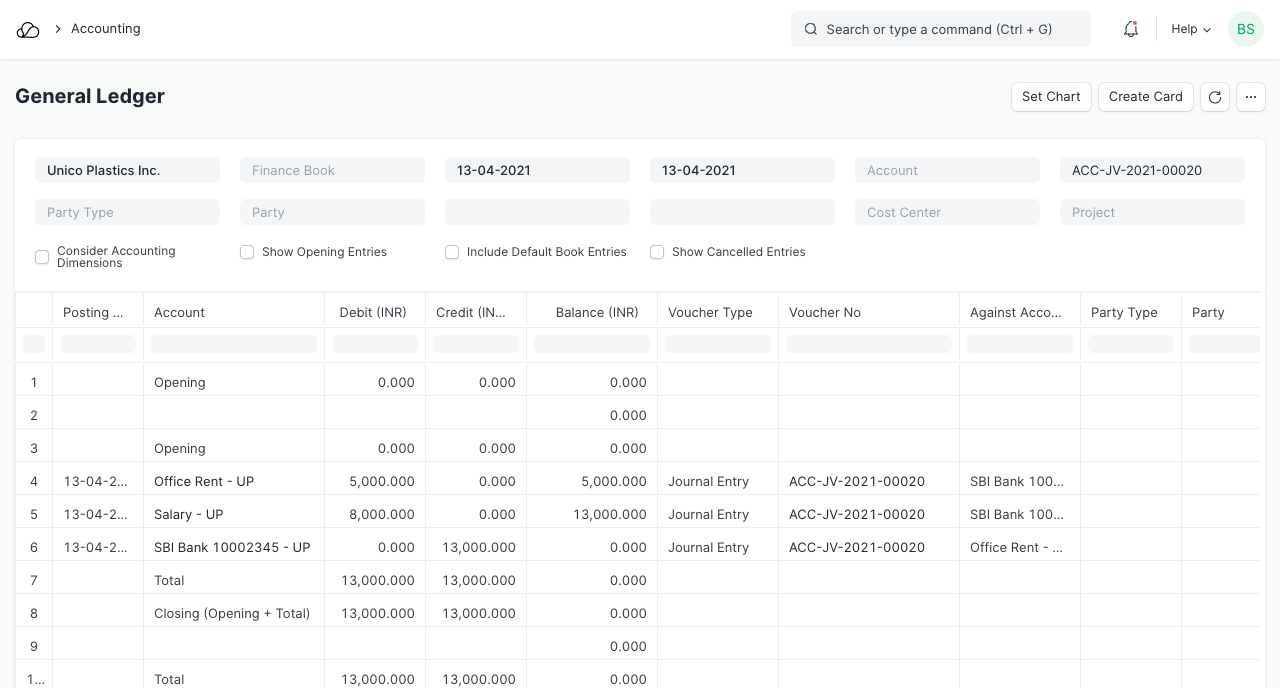

At the end of the month, the company paid the rent amount of stall ($5000) and salary of one employee ($8000), who joined from the very first day.

4. Booking Profit

As month progress, company purchased more raw materials for the business. After a month he books profit to balance the "Balance Sheet" and "Profit and Loss Statements" statements. Profit belongs to Mama and not the company hence its a liability for the company (it has to pay it to Mama). When the Balance Sheet is not balanced i.e. Debit is not equal to Credit, the profit has not yet been booked. To book profit, the profit and loss accounts have to be reset. The profit/loss is transfered to the Liability account and the profit/loss statement starts fresh. This is done using a Period Closing Voucher.

Explanation: Company's net sales and expenses are $40000 and $20000 respectively. So, company made a profit of $20000. To make the profit booking entry, "Profit or Loss" account has been debited and "Capital Account" has been credited. Company's net cash balance is $44000 and there are some raw materials available worth $1000.